Why Invest in Real Estate?

Never invest in a business you cannot understand. – Warren Buffett

Real estate is something people can see, feel, and even touch. Whether you own a home, a condominium, rent an apartment or even live on a boat, you are in touch with real estate. How about those shares you own in the technology firm that is propelling man into space or maybe creating cures for disease? You review your investment on paper several times a year but can you really touch your investments? As amazing as technology and bio-science are, can you really understand it?

An investment in real estate can provide an emotional trigger. Sure, the intention is to engage in a financial investment that will create passive income but you are also making an investment in society. In commercial real estate, the goal is to improve a purchased property in order to increase the property’s value but you are also improving the lives of your residents as well as the surrounding community. Real estate investments offer you a balance of financial gain and emotional satisfaction – it’s a feel-good investment!

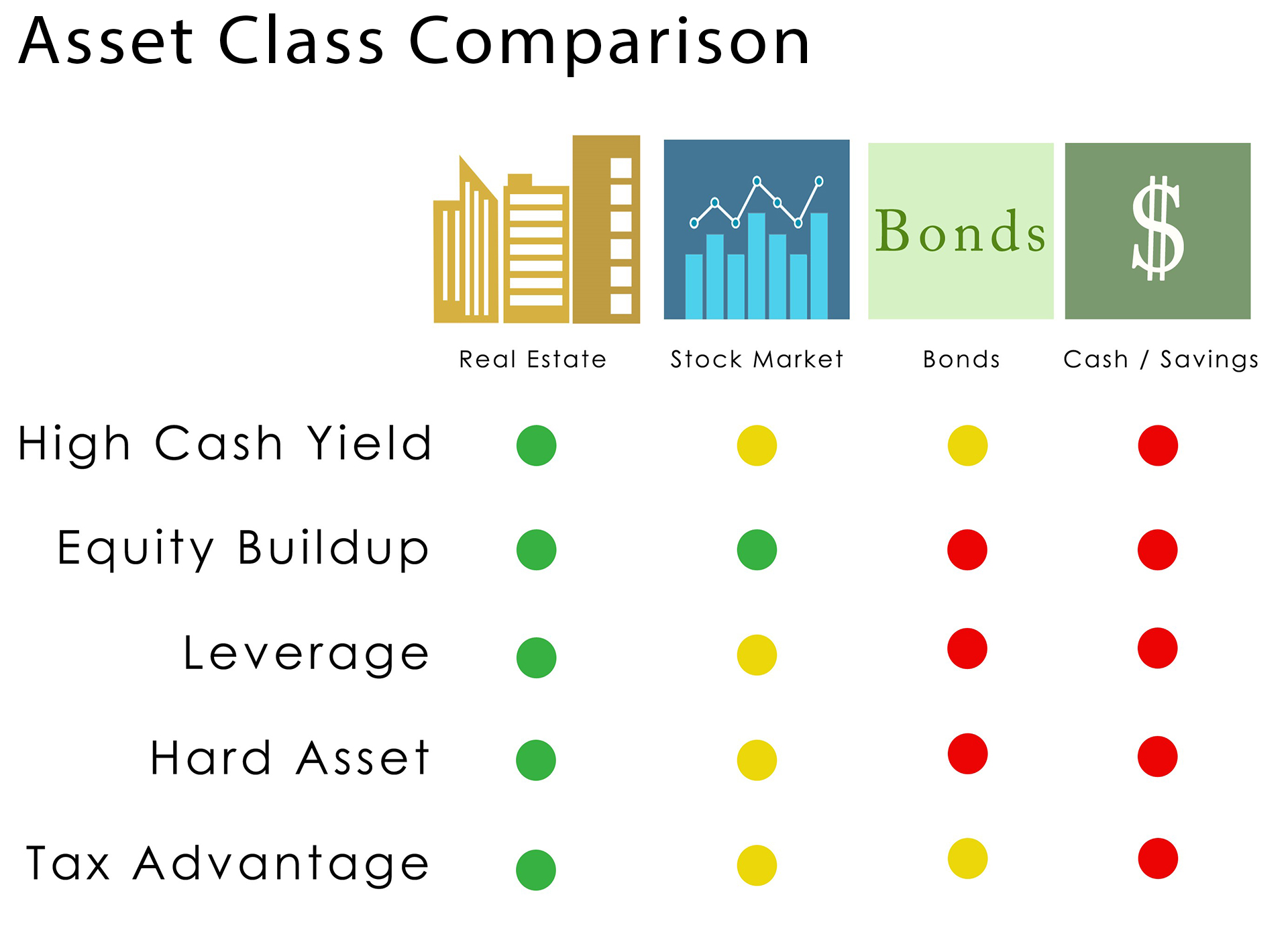

While most financial advisors guide their clients to diversify their portfolios, most investors have their preferences. Many enjoy the potential benefits of the stock market while others may view it as an intangible asset that they can’t control.

Bonds are not as profitable as most investors would like and the investment timeline can be an obstacle. As for cash, who can argue that having a percentage of cash is a smart and safe strategy but with interest rates where they are and have been for some time, can cash create the wealth that is desired?

This brings us to real estate assets. Real Estate is tangible and for the most part can be controlled by an investor. Most importantly, real estate has a decades long history of performance and

wealth creation.

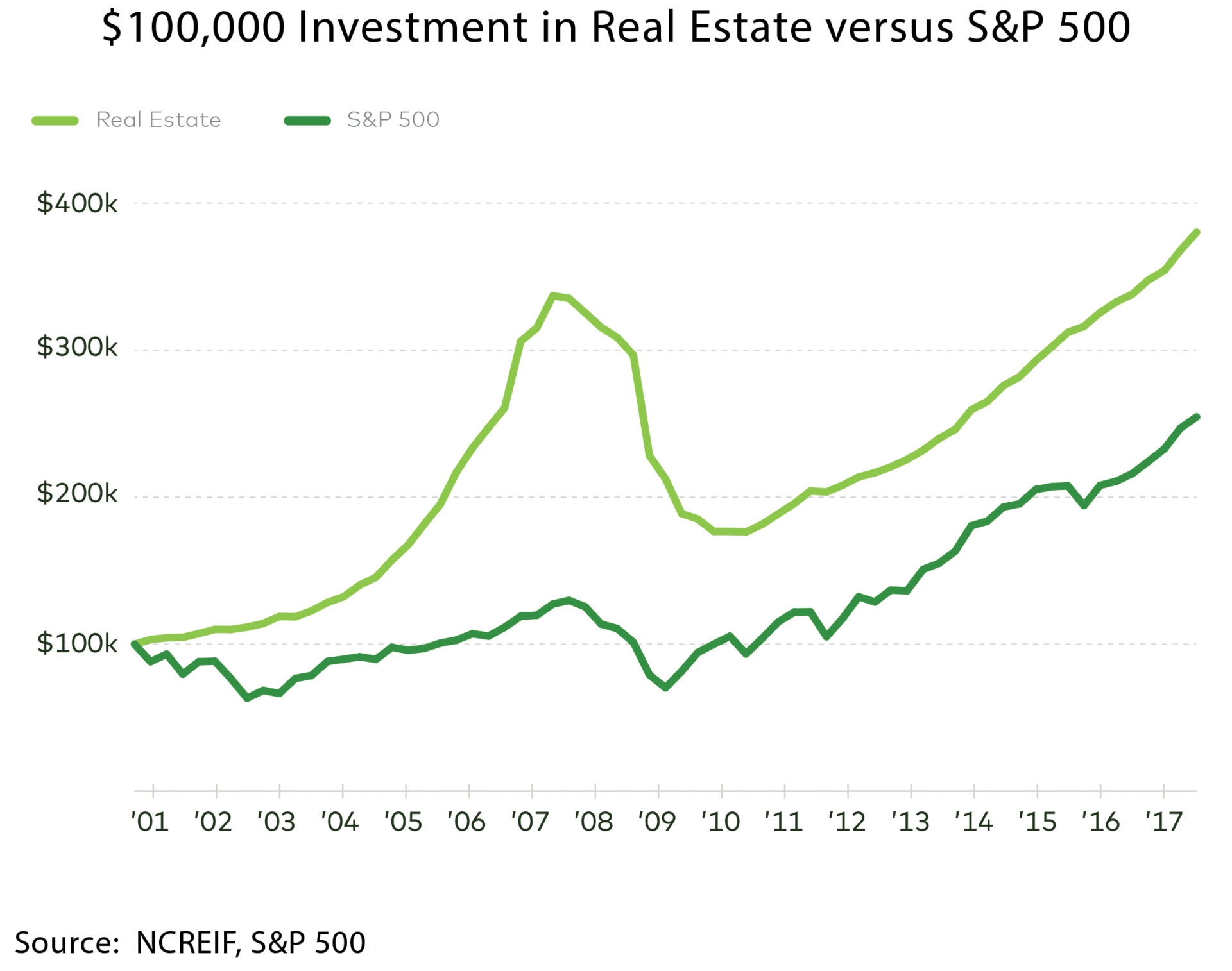

Real estate offers investors the ability to generate high absolute returns. An absolute return takes into account appreciation, depreciation, and cash flow to measure the amount of money an investment earns over time. Returns are expressed as a percentage gain or loss on the initial investment. As an example, a $100,000 investment in private real estate beginning on January 1, 2001, would have been worth about $380,000 on March 1, 2017. That same $100,000 investment in the S&P 500 would be worth $255,000 on March 1, 2017, as illustrated in the chart left.

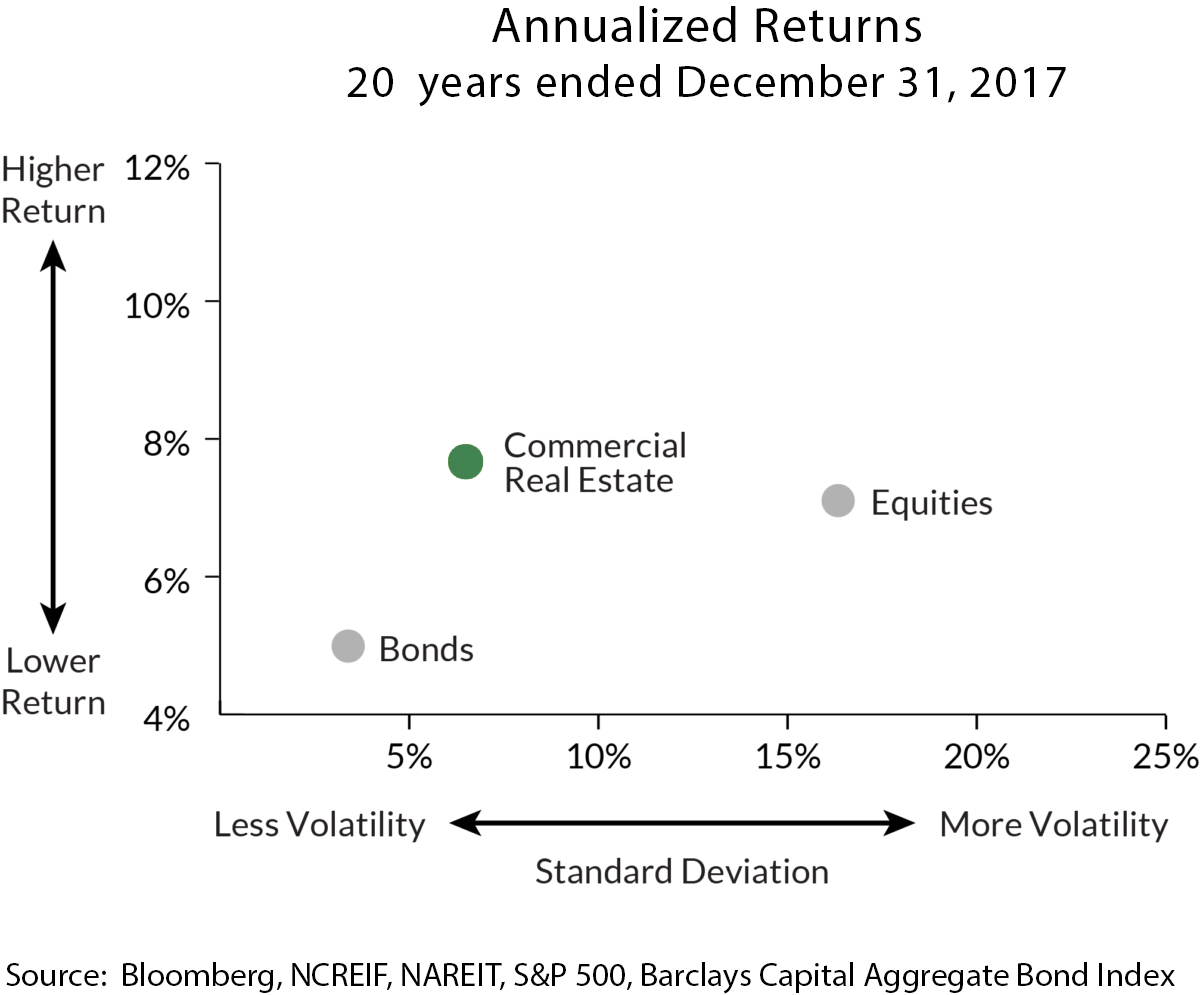

Over the last 20 years, compared to equities, commercial real estate was less volatile but generated higher returns. Over the same time period, bonds had the lowest volatility but an inferior return.